In the fast-moving world of online trading, choosing a reliable broker can make all the difference between a seamless trading experience and endless frustration. With the growing number of forex and CFD brokers available today, traders must look beyond marketing promises and focus on real performance—especially when it comes to deposits and withdrawals. One of the platforms that has recently drawn significant attention is Vantage Markets. In this Vantage Markets review, we’ll uncover the truth about how the broker handles deposits, withdrawals, and overall transparency, helping traders decide whether it’s truly worth their trust.

Understanding Vantage Markets: A Trusted Global Platform

Vantage Markets is a globally recognized forex and CFD broker that has been serving traders since 2009. Headquartered in Sydney, Australia, the company operates under the regulation of multiple reputable authorities, including the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA). These regulatory bodies ensure that Vantage adheres to strict financial standards, providing traders with a secure and transparent environment.

The platform is designed to meet the needs of both beginners and professionals, offering access to more than 1,000 instruments across forex, indices, commodities, shares, and cryptocurrencies. What sets Vantage apart is its dedication to providing an optimal trading experience through platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-known for their stability, advanced charting tools, and lightning-fast order execution.

Vantage also provides several account types—Standard STP, Raw ECN, and Pro ECN—catering to different trading preferences. The broker’s competitive spreads, low commissions, and leverage options make it an attractive choice for traders seeking both flexibility and value. However, while trading conditions are vital, understanding how easily you can move your money in and out of the platform is equally important.

That’s why traders often turn to reliable sources such as https://www.secretstotrading101.com/forex-brokers/vantage-markets/ for in-depth reviews and unbiased insights into how Vantage Markets truly performs when handling financial transactions.

Depositing Funds: Convenience and Flexibility for Traders

Before any trading can begin, funding your account is the first crucial step. Vantage Markets makes this process straightforward, allowing users to deposit funds through a wide range of payment methods. These include credit and debit cards, bank wire transfers, and popular e-wallets such as Neteller, Skrill, and FasaPay. The availability of local payment options also ensures that traders from different regions can deposit funds using familiar and accessible methods.

Deposits are typically processed instantly when made via cards or e-wallets, while bank transfers may take one to three business days, depending on the financial institution. One major advantage that Vantage offers is its policy of not charging any deposit fees. This allows traders to put their full investment amount to work without worrying about deductions.

Security is another area where Vantage shines. The company uses advanced encryption technology to safeguard all financial transactions. Client funds are kept in segregated accounts with top-tier banks, ensuring that personal and trading funds remain separate. This provides peace of mind to traders who prioritize financial safety.

The broker also supports multiple base currencies—USD, GBP, EUR, and AUD—allowing users to avoid conversion costs when depositing funds. This feature is particularly beneficial for international traders who want to maintain control over their capital without unnecessary currency exchange fees.

For new traders, the minimum deposit requirement depends on the account type chosen. The Standard STP account has a low entry barrier, making it ideal for beginners, while the Raw ECN and Pro ECN accounts, designed for professional traders, require higher initial deposits but offer tighter spreads and faster execution speeds.

Overall, Vantage’s deposit system is efficient, transparent, and secure, setting a positive tone for traders right from the start.

Withdrawal Process: Transparency and Speed in Action

Withdrawals are where many brokers either gain or lose their credibility. For traders, getting access to profits easily and quickly is just as important as executing trades successfully. Fortunately, Vantage Markets maintains an impressive record in this area, emphasizing efficiency, transparency, and reliability.

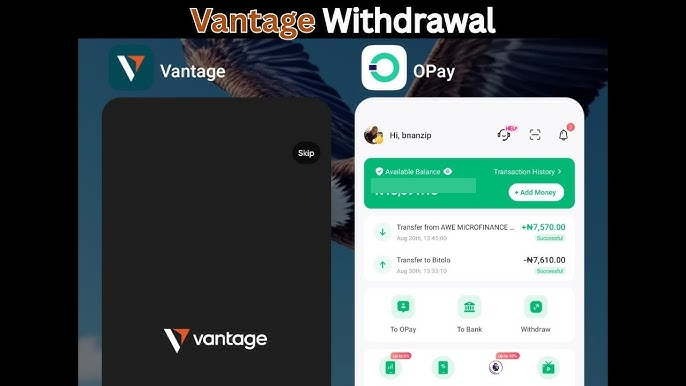

To withdraw funds, users log into their secure client portal, select the withdrawal option, choose the preferred payment method, and specify the amount. The broker processes most withdrawal requests within 24 business hours. However, the time it takes for funds to reflect in a user’s account depends on the withdrawal method. E-wallet withdrawals, for instance, are often completed within hours, while bank transfers can take up to five business days.

One of the strongest aspects of Vantage’s withdrawal system is that it enforces a same-method policy—meaning that traders must withdraw using the same method they used to deposit. This policy complies with international anti-money laundering (AML) laws and ensures secure fund transfers. While it might seem restrictive, this practice adds an important layer of protection for users.

Importantly, Vantage does not charge internal withdrawal fees, though third-party payment providers might impose small transaction costs. The absence of hidden fees further strengthens the company’s reputation for transparency. Many traders appreciate that what they see on the platform is exactly what they get—no extra charges or unexpected deductions.

User reviews on independent trading forums consistently highlight Vantage’s reliability when it comes to withdrawals. Traders frequently mention receiving their funds promptly, with clear communication from the broker throughout the process. This consistency reinforces the platform’s credibility and helps position it as a broker that values customer trust.

For traders who prioritize fast and smooth transactions, Vantage Markets demonstrates that it not only understands their needs but also delivers on its promises.

Security, Verification, and Compliance

In the financial world, security and compliance are non-negotiable. Vantage Markets goes to great lengths to protect its users’ accounts and transactions. Before processing any withdrawal, the broker requires clients to complete a verification process, known as KYC (Know Your Customer). This involves submitting proof of identity (such as a passport or national ID) and proof of address. Though some may find this process time-consuming, it’s a crucial step to prevent fraud and ensure regulatory compliance.

The broker’s regulatory oversight by ASIC and CIMA ensures that it follows strict rules regarding client fund handling and financial reporting. These agencies require Vantage to maintain segregated client accounts and submit regular audits, offering traders an additional layer of confidence.

Beyond regulation, Vantage employs advanced security protocols to safeguard data and transactions. SSL encryption and secure firewalls protect client information from unauthorized access. This means that whether you’re depositing funds, withdrawing profits, or simply logging into your account, your data remains protected at all times.

The broker’s transparency also extends to its website and customer communication. Every detail about payment methods, processing times, and potential third-party fees is clearly listed in the client portal. This openness aligns with the company’s philosophy of building long-term trust rather than relying on marketing hype.

Ultimately, Vantage’s strong focus on regulation and security gives traders peace of mind knowing that their investments are managed by a broker that values integrity as much as performance.

Customer Experience and Industry Reputation

Customer experience plays a key role in determining a broker’s credibility, and Vantage Markets has earned strong reviews in this regard. The company provides 24/5 multilingual customer support via live chat, email, and phone. Whether it’s a question about deposit confirmation or a withdrawal delay, the support team is known for being responsive and professional.

Many traders appreciate Vantage’s commitment to transparency when handling client concerns. If a withdrawal is delayed due to verification issues or public holidays, the broker promptly informs clients, rather than leaving them uncertain about their funds. This proactive communication style builds trust and reinforces Vantage’s image as a client-focused broker.

The company’s website also features a comprehensive knowledge base, providing step-by-step guides for deposits, withdrawals, and account management. This self-help approach empowers users to solve common issues quickly and efficiently without always relying on customer support.

Independent review sites like Trustpilot and Forex Peace Army reflect a generally positive sentiment toward Vantage Markets. Users frequently praise its fast processing times, transparent fee structure, and reliable customer service. While every broker has occasional negative reviews, Vantage’s consistent effort to address feedback demonstrates a commitment to continuous improvement.

Another point worth noting is that Vantage invests heavily in education and trading tools. The platform offers webinars, video tutorials, and market analysis reports to help traders make informed decisions. This focus on knowledge sharing further enhances the customer experience and supports traders at every skill level.

By combining responsive support, transparent communication, and robust educational resources, Vantage Markets creates a trading environment that prioritizes both user satisfaction and long-term trust.

Is Vantage Markets Worth It? A Final Evaluation

After examining its deposit and withdrawal systems, customer experience, and regulatory framework, it’s clear that Vantage Markets stands out as one of the more reliable brokers in the forex and CFD trading space. The platform’s commitment to transparency, security, and efficiency in handling client funds sets it apart from many competitors.

Deposits are fast, easy, and free of internal fees, while withdrawals are processed swiftly and securely. The broker’s regulatory compliance with major authorities like ASIC and CIMA ensures that traders’ funds remain protected. Add to that an intuitive trading environment, advanced technology, and dedicated customer support, and it’s easy to see why so many traders trust Vantage as their preferred broker.

Of course, as with any trading platform, users should always exercise due diligence. Reading verified reviews, understanding withdrawal policies, and confirming payment methods can help ensure a smoother experience. However, based on extensive analysis and user feedback, Vantage Markets delivers on its promises—particularly when it comes to managing deposits and withdrawals with professionalism and transparency.

Conclusion

In summary, Vantage Markets Review: The Truth About Withdrawals and Deposits reveals a broker that has successfully combined innovation, regulation, and trust. From instant deposits to secure withdrawals, every aspect of its financial process reflects efficiency and integrity. The platform’s transparent policies, regulatory backing, and user-friendly interface make it a strong choice for traders seeking both reliability and performance.

Whether you’re just starting your trading journey or managing a professional portfolio, Vantage Markets offers a secure and convenient environment to handle your funds. By maintaining a clear commitment to transparency and customer satisfaction, the company has earned its reputation as a dependable partner in the ever-evolving world of online trading.